nys workers comp taxes

You are responsible to pay. Since Worker A is actually slated to get 1800 total in.

The Ultimate Guide To Workers Compensation Laws In New York

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable.

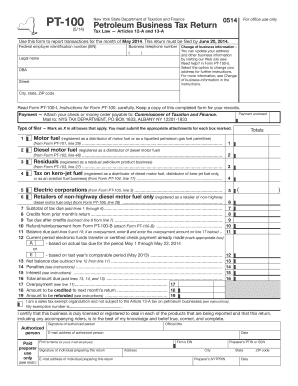

. The franchise tax based on premiums also is referred to as premium tax. The IRS in Publication 907 specifically states that workers. Overview When the Workers.

Payroll - At every pay period withhold Social Security Medicare and income taxes from the employees paycheck per the employees W4 and IT-2104 elections and make employer. City worker with injuries to left side leg and arm as well as right arm. NYSIFs Climate Action Plan.

The Division strives to provide employees. Employers may also be required to. In New York workers compensation benefits are not considered taxable income for federal state and local tax purposes.

The tax rate is 175 for accident and health premiums and 200 for all other non-life premiums. 63 rows NY Rates are about 155 higher than the national median. As part of the 2022 State of the State Governor Hochul directed New York State authorities public benefit corporations and NYSIF totaling roughly 40.

160 Broadway 10th Floor New York NY 10036 212 563-1900. Wealthier individuals pay higher tax rates than lower-income individuals. Also under IRS regulations non-taxable workers.

For injuries that happened between July 1 2020 and June 30 2021 the maximum is 96678 per week. No permanent disability claimant returned to full duty at work. While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers.

New Yorks income tax rates. The Workers Compensation Division administers the claims of all covered employees who are injured on the job or incur an occupational disease. The minimum tax is 250.

Permanent disability open. Up to 25 cash back The legal maximum depends on the date of your injury. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

Filing requirements NYS-45 NYS-1 Filing methods. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. According to guidance from the New York.

However Workers Compensation 1084 exempts the surcharge that insurers charge their insureds. The 80 threshold allowed by the SSA is 1600 80 of the original 2000 the worker used to earn before the injury. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees.

There are eight tax brackets that vary based on income level and filing status. Workers Comp Exemptions in New York Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury.

Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income. The quick answer is that generally workers compensation benefits are not taxable. Forms required to be filed along with instructions can.

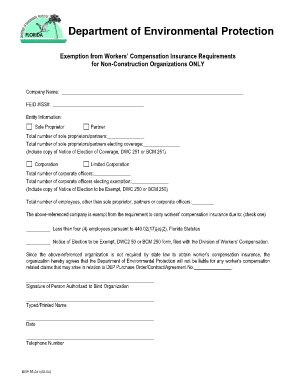

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Is Workers Comp Taxable Workers Comp Taxes

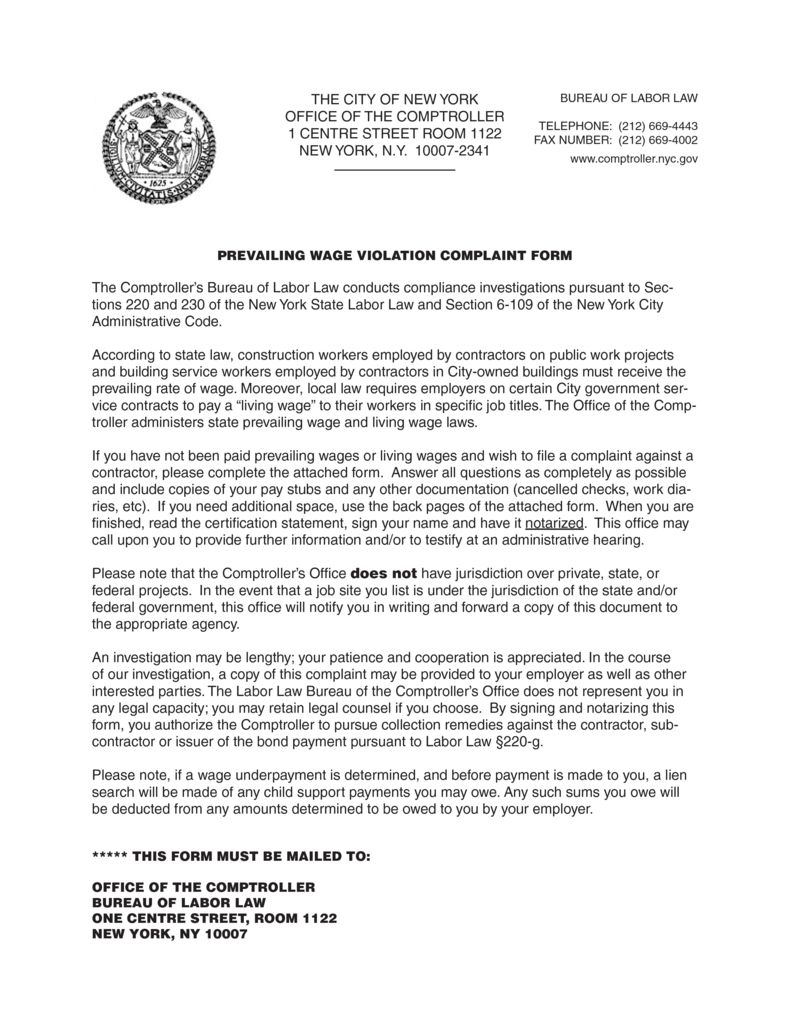

Workers Rights Office Of The New York City Comptroller Brad Lander

Section 2 Calculation Of Loss Compensation Vcf

Does Workers Comp Count As Income Learn How Worker S Comp Funds Are Defined

Essential Guide Ny Film Tax Credits Wrapbook

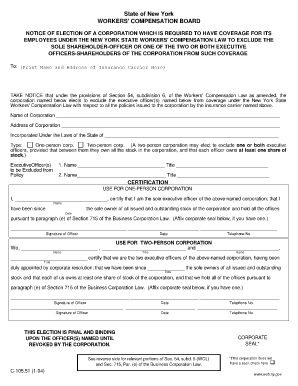

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Employer Compensation Expense Tax About New York State S New Payroll Tax

Ny Workers Compensation Insurance Get Insured Fast

Workers Compensation No Fault Billing Healthcare Billing Services Of Ny

The Complete Guide To New York Payroll Payroll Taxes 2022

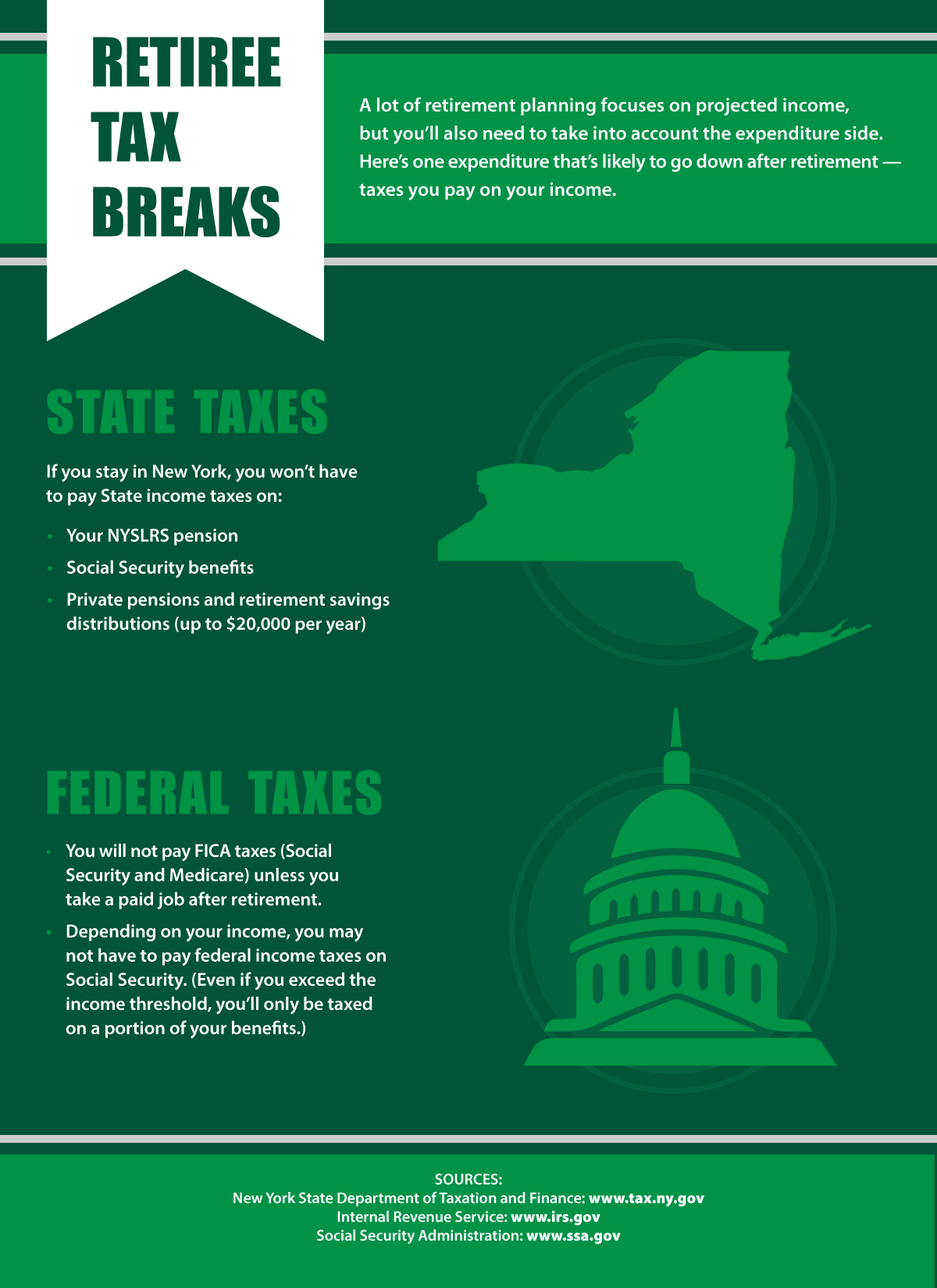

Taxes After Retirement New York Retirement News

Payroll Tax Calculator For Employers Gusto

New York City Workers Compensation Lawyers Nyc Work Injury Firm

Working Remotely Making The Convenience Rule Work For Telecommuting Ey Us

Recent Workers Compensation Decisions On 114 A Show Fraud Doesn T Pay In New York Knowledge Goldberg Segalla